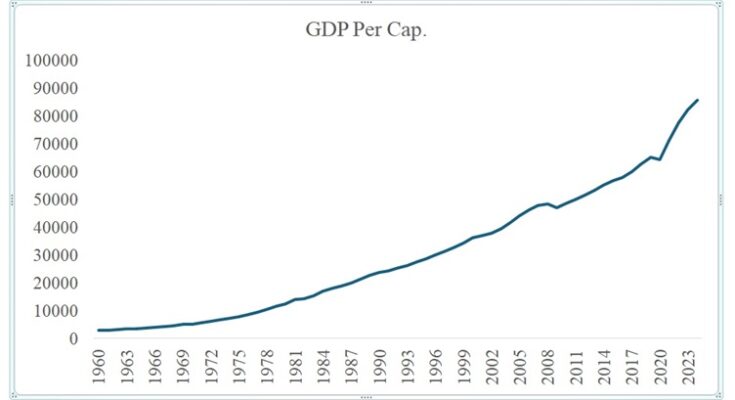

Recent data from the World Bank reveals a striking contradiction between macroeconomic progress and individual economic wellbeing. Between 1960 and 1990, the United States’ GDP per capita rose from approximately $3,000 to $24,000, representing a compound annual growth rate (CAGR) of 7.32%. Over the next 34 years (1990–2024), GDP per capita increased further from $24,000 to about $86,000, a still-impressive 3.9% CAGR. By traditional economic standards, such numbers would signify sustained prosperity and improved living standards.

Yet, the lived experience of many Americans — and indeed, citizens across the developed and developing world — tells a different story. Despite consistent GDP growth, median living standards have stagnated, homeownership rates among young adults have declined, and wealth inequality has widened dramatically. The explanation lies not in productivity or innovation, but in asset price inflation.

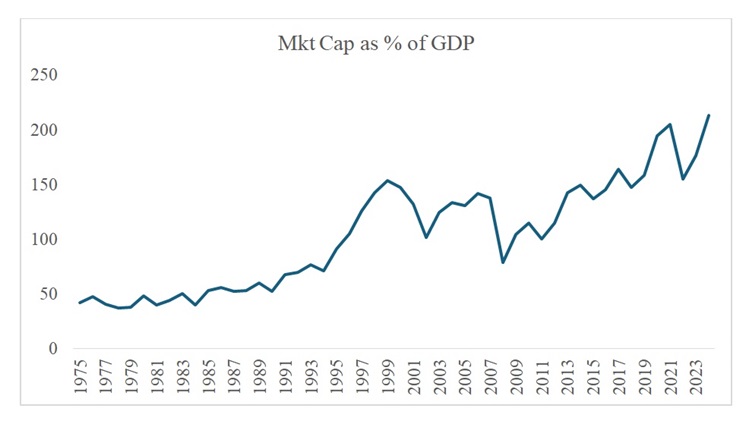

Take the U.S. stock market as an example. In 1960, the market capitalization of U.S. equities stood at about 42% of GDP. By 1990, that figure had only modestly increased to 52%, a CAGR of 0.71%. However, between 1990 and 2024, market capitalization surged to approximately 213% of GDP, translating to a 10.63% CAGR—nearly three times the rate of GDP per capita growth over the same period. Similar patterns are evident across real estate, cryptocurrencies, gold, and other asset classes.

This divergence between income growth and asset price growth fundamentally alters wealth dynamics. In theory, productivity growth should fuel both GDP and asset prices—people earn more, save more, and invest more. But when asset prices grow faster than productivity, the returns on capital vastly outpace the returns on labor. The result is a structural shift: wealth becomes increasingly determined by asset ownership rather than by work.

This helps explain the growing disillusionment in modern economies. While aggregate output expands, access to wealth creation mechanisms—such as property or equities—becomes increasingly exclusionary. The economy grows richer, but the typical worker feels poorer.

The New Economic Imperative: Own Assets or Fall Behind

As artificial intelligence accelerates automation and erodes the labor premium, this imbalance is likely to intensify. The rewards of economic growth will accrue primarily to asset holders—those who own the technologies, platforms, and intellectual property driving productivity gains. In this emerging paradigm, owning productive assets (stocks, real estate, digital assets) is no longer a path to wealth, but a defensive necessity for maintaining economic parity.

In essence, the data tells a sobering truth:

The 21st-century economy rewards capital, not labor. To stay afloat, one must own a piece of the future.

– Augustine Akande writes in from Winnipeg, Canada.